Local bank is a major sponsor of the annual Fourth of July Parade

Published in the July 9-23, 2014 issue of Morgan Hill Life

By Staff Report

Photo by Marty Cheek

Employees and family wave to the crowd from the CommonWealth Credit Union float during this year’s Fourth of July parade.

CommonWealth Credit Union was founded in 1958 as a not-for-profit financial option to traditional banks for working-class families in Santa Clara County. The first branch office was opened in a small garage by volunteers Frank and Grace Coombs.

In 1987, CommonWealth opened the doors to a Morgan Hill branch and has been a fixture in the community ever since. Morgan Hill Life recently asked Jim Boyle, the vice president of marketing at CommonWealth, how the credit union is involved in the local community and what sets it apart from other financial institutions.

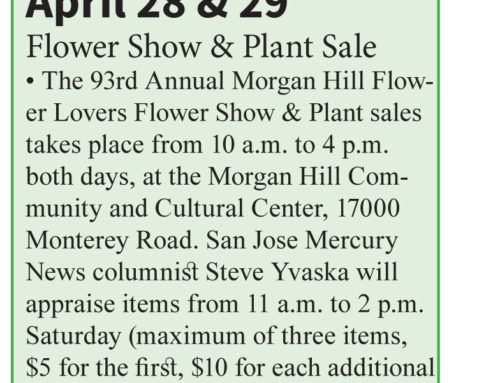

For several years, CommonWealth has been the main sponsor of the Morgan Hill Independence Day Parade, the official parade of Santa Clara County. Why did the credit union decide to play such an active role in one of the most beloved annual events of Morgan Hill?

We believe that by supporting and participating in local events, schools and non-profits, we strengthen the communities we serve. Because the parade is so beloved, it just seemed natural that we participate. The parade is a microcosm of local community business and organizations — it just feels right to be a part of it.

What other community involvement does CommonWealth have an active role in with Morgan Hill?

We partner with a host of local community organizations, doing everything from helping to build bikes for underprivileged children, painting houses for disabled seniors, to teaching kids in grade school about finances. We keep track of the time our employees spend in the community and in 2013 our employees spent hundreds of hours making a difference. As a member-owned financial institution, it’s easy for us to raise funds for a number of worthy organizations such as The Make-A-Wish Foundation, Children’s Miracle Network, Turning Wheels for Kids, Operation Freedom Paws and others.

While we pride ourselves on being an organization that gives back to our community, our members also play a huge role in this. Their generous donations have helped us to provide much-needed funds to many local charities over the years.

People are sometimes confused about the difference between a bank and a credit union. What makes credit unions such as CommonWealth unique compared with the typical bank or savings and loan?

Credit unions are member-owned financial cooperatives run by a volunteer board of directors. When you join a credit union you’re more than a member, you’re an owner — and that means you have a say in how the credit union is run. Credit unions provide the same products and services as other financial institutions — but credit unions are not-for-profit and exist to help people, not to make a profit.

As such, all earnings are returned to their members in the form of high-interest savings and low rate loans. And last but not least, credit unions live by the philosophy of “people helping people.” This means we are committed to our communities and we have a genuine interest in improving the financial lives of our members.

CommonWealth also provides services such as investment products, retirement planning and various insurance options. How people might benefit from these services at CommonWealth?

Credit unions offer the same products and service that for-profit banks offer from checking accounts and Visa cards to financial planning.

Members benefit in two ways, directly through great service with their interest in mind and indirectly through our re-investment in their local communities. All of our earnings stay local. There are no out-of-town stock holders siphoning off profits to far off places.