Social Security provides about 40 percent of retirement income for most

Published in the July 23 – August 5, 2014 issue of Morgan Hill Life

By Marisa Otto, CFP

Marisa Otto

Dear Marisa, what’s smarter, paying off debts or investing?

Every so often, you’ll have some extra disposable income. Should you use this “found money” to pay down debts or invest for the future?

There’s no clear-cut answer. If you’ve got a high-rate consumer loan, you might want to get rid of it as quickly as possible. But if you don’t owe a lot, and your monthly payments aren’t really affecting your cash flow that much, you might want to consider putting any extra money into an investment. For example, you might decide to fully fund your IRA for the year before tackling minor debts.

You could use the extra money to make additional mortgage payments; you might even feel more secure by lowering your mortgage. However, you may gain more liquidity and flexibility if you put your money into investments such as stocks and bonds, rather than into your mortgage.

If you do come across some extra money, take advantage of it — and when choosing to pay down debts or boost your investments, think carefully.

Dear Marisa, what financial tips do you have for a newly single woman?

Here’s something to think about: The average woman’s income drops by 37 percent after divorce, according to the U.S. Census Bureau. So, if you’re a newly single woman, you may want to consider these steps:

First, get help from a financial advisor to clarify your spending needs, cash flow and investment strategy. You might also consider working with a trust company, which can help you manage your finances in several ways.

Next, contribute as much as you can afford to your 401(k) or other employer-sponsored retirement plan. At a minimum, put in enough to earn your employer’s match, if one is offered.

Also, try to put aside several months’ worth of living expenses in a liquid account. This emergency fund can help you avoid dipping into long-term investments to pay for unexpected costs, such as an expensive car repair.

Divorce is difficult. But by making the right moves, you can help brighten your financial picture.

Dear Marisa, should I consider becoming a “hands-on” investor?

If you want to be a “hands-on” investor, you’ll need to stay busy. You’ll have to study the financial markets, stay up-to-date on changing investment environments and monitor your portfolio.

Some find that they don’t have the time or expertise to manage this investment process, so they turn to financial advisors. However, even though a financial advisor will make recommendations, you are the one to make the decisions.

If you’d like more of a “hands-off” approach, you could invest in an advisory program through a financial advisor. With these programs, professionals manage your money and use a systematic rebalancing process to help you stay on track.

Make sure you understand the differences between the investing methods, including fees and costs. Whether you make your own decisions in consultation with a financial advisor or delegate decision making through an advisory program — or a combination of both — you should learn as much as possible about your investments. Whichever method you decide on, remember that investing involves risk, and performance is never guaranteed. Knowledge is power — and that’s certainly true in the investment arena.

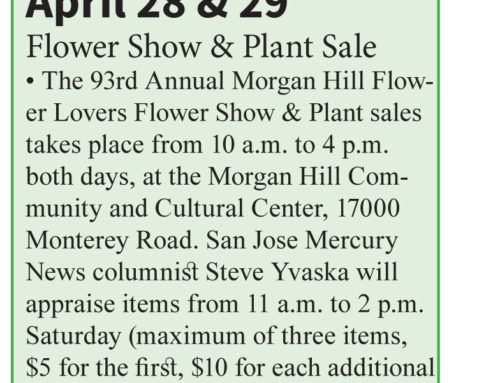

Dear Marisa, how will Social Security fit in my retirement income strategy?

It’s an important question to answer as you start thinking about your overall retirement income strategy.

You can start collecting Social Security as early as 62, but your monthly payments could be reduced by as much as 30 percent if you take your benefits before your “full” retirement age, which will likely be either 66 or 67. However, if you delay taking benefits beyond full retirement age, your checks would increase every year until age 70, at which point your payments will “max out.”

So, if you have sufficient income, you could avoid tapping into Social Security once you’re 62.

In any case, you will certainly need other sources of income — such as your IRA and 401(k) — because Social Security provides only about 40 percent of retirement income for the average 65-year-old today. Consequently, in the years and decades before you retire, contribute as much as you can possibly afford to whatever retirement accounts you have available.

You work hard your entire life to earn Social Security benefits — take full advantage of them.

Marisa C. Otto, CFP, is a financial planner for Edward Jones. She can be reached at (408) 778-4400 or at www.edwardjones.com/en_US/fa/index.html&CIRN=305189