Most people should have a trust to protect their home and other assets, and their bank and investment accounts should be funded into their trust.

By James Ward

James Ward

Where are your accounts? If you have a trust, have you funded your accounts into the trust? (This is sometimes called re-titling, whereby you change the name of your account to be the trust.) Too often, people don’t handle their accounts properly and then we have additional and unnecessary issues to deal with upon their death. And when will you die? We don’t know, so you need to have everything in order long before then.

As an example of passing quicker than expected, I had two clients come see me last week. One was an existing client, and the other was a new client. Both were smiling and talking and walking just fine, but both told me that they had just been put on hospice and only had three months or so to live. It was shocking news to me in both cases because both of them looked just fine.

To make matters even worse, the doctors’ estimates of three months ended up being very far off the mark. We rushed the documents to one within three days because she was fading fast, and then she passed within 10 days of telling me she had three months left to live. It was a similar story with the new client, but he slid downhill dramatically within three or four days of seeing me, and he was never able to sign any new documents.

To make matters even worse, the doctors’ estimates of three months ended up being very far off the mark. We rushed the documents to one within three days because she was fading fast, and then she passed within 10 days of telling me she had three months left to live. It was a similar story with the new client, but he slid downhill dramatically within three or four days of seeing me, and he was never able to sign any new documents.

Death or stroke can come fast. Much faster than many people think. Make sure your affairs are in order.

One client recently passed with a $6,000 account outside of the trust and with no beneficiary named for that account. That’s a problem that can certainly be resolved, but it takes extra time and money. Why wasn’t it cleaned up before their death? Don’t leave others cleaning up your mess.

One client recently passed with a $6,000 account outside of the trust and with no beneficiary named for that account. That’s a problem that can certainly be resolved, but it takes extra time and money. Why wasn’t it cleaned up before their death? Don’t leave others cleaning up your mess.

An attorney client of mine recently lost his brother-in-law, but he knew his sister and brother-in-law had prepared a trust a few years ago, so he checked with his sister to make sure everything had been retitled to the trust, but no. The brother-in-law had a $300,000 investment account that was in his name alone, not named in the trust, and with no named beneficiaries. Are you kidding? Why?

These issues can be resolved fairly easily if people aren’t fighting, but at what cost of time and money? What if part passes outside the trust to a disabled child and now that child loses their disability benefits? That could be a serious issue.

These issues can be resolved fairly easily if people aren’t fighting, but at what cost of time and money? What if part passes outside the trust to a disabled child and now that child loses their disability benefits? That could be a serious issue.

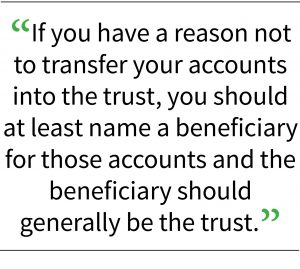

Most people should have a trust to protect their home and other assets, and their bank and investment accounts should be funded into their trust. (IRA and 401k accounts generally do not belong in the trust.) If you have a reason to not transfer your accounts into the trust, you should at least name a beneficiary for those accounts, and the beneficiary should generally be the trust.

There are always exceptions, but this is the general rule. When you leave this world, don’t leave problems for others.

In the case of the widow with $300,000 in her husband’s account, she said that she just let her husband handle everything by himself, but now the problem belongs to her.

The problem we most commonly see isn’t that the person had a special reason to not fund their accounts into the trust, but they simply got busy with other details of life and never got around to funding those accounts into their trust.

Don’t let that happen to you. Get it done. Be proactive.