If Part D drug prices rise faster than inflation in 2023, the drug company must rebate the difference to Medicare.

![]()

By Cheri Brown

Cheri Brown

When people ask me why Medicare is so confusing, I jokingly respond: “because it was invented by Congress.” As Congress passes bills, they often include new Medicare regulations and reforms. The Inflation Reduction Act of 2022 affects Medicare beneficiaries in several ways.

When people ask me why Medicare is so confusing, I jokingly respond: “because it was invented by Congress.” As Congress passes bills, they often include new Medicare regulations and reforms. The Inflation Reduction Act of 2022 affects Medicare beneficiaries in several ways.

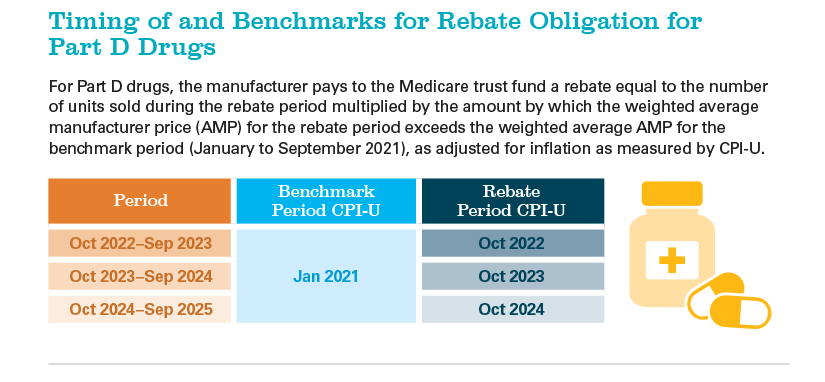

The 2023 changes include no co-pay for many Part D vaccines. For example, I have had clients complain about the copay for Shingrix, a Shingles vaccine — often more than $100 while copays for flu and pneumonia vaccines are $0. This new regulation will lower the Shingrix vaccine copay to $0. Insulin costs have been a challenge for many of my diabetic clients, in 2023 the copay for insulin is reduced to a maximum of $35. Finally, if Part D drug prices rise faster than inflation in 2023, the drug company must rebate the difference to Medicare.

In 2024 the maximum out of pocket for Part D drug costs will be limited to $4,000 per year. In prior years if a Medicare beneficiary spent the maximum amount catastrophic coverage began; they paid either a small co-pay or 5 percent of the medication cost. In 2024 the 5 percent co-insurance will be eliminated; they will only pay the small copay. Part D low-income subsidy helps people pay for the Part D premium and their Part D copays, the people who will qualify for 100 percent of this subsidy will increase to allow folks making up to 150 percent of the Federal Poverty Level to qualify for lower Part D drug costs.

From 2024 to 2030 the Part D premiums will be limited to a 6 percent annual increase. From 2024 to 2029 Medicare will be permitted to negotiate with the drug companies on the highest cost medications available. This is the first time that Medicare has been allowed to negotiate. Many pundits blame the high cost of prescription drugs on the inability to negotiate pricing. While others argue that the free market encourages innovation with drug research. By 2030 we will know which line of reasoning is correct.

In 2025 the maximum out of pocket for Part D drugs will be limited to $2,000. For people on high-cost medications with no generic or who cannot use generics this will be a huge improvement to their lifestyle. Unfortunately, many seniors must choose between medications and other living expenses.

If you find Medicare confusing, you can turn to a licensed insurance agent like Cheri Brown or contact the local HICAP office to review your needs and how the changes implemented by the Inflation Reduction Act will affect you.

Cheri Brown is a licensed insurance agent with decades of experience with Medicare health insurance plans. She can be contacted at (408) 476-0034, [email protected] and through her website www.cheri-brown.com.