Most workers surveyed understand the importance of saving for retirement

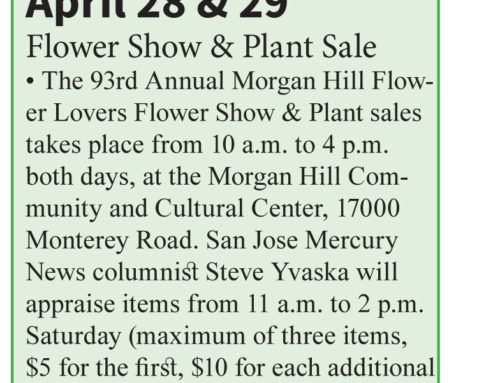

Published in the July 9-23, 2014 issue of Morgan Hill Life

By Dan Newquist

Dan Newquist

The dream of a financially comfortable retirement was tested severely by the recent recession as workers lost jobs, were forced into early retirement or took on supporting other family members less financially fortunate. Americans tapped into their nest eggs and focus shifted to meeting current obligations out of necessity, and away from saving for their retirement.

As we emerge from the recession, retirement confidence seems to be on the rise from record lows over the past five years. The 2014 Annual Retirement Confidence Survey (RCS) reported 18 percent of American workers indicated they were “very confident” they will have enough money to retire comfortably, compared to just 13 percent in 2013, and 37 percent are “somewhat confident.”

Survey results reveal the rise in confidence came largely from workers in higher income households ($75,000 and up) and those who had money in retirement plans, including employer sponsored plans like 401(k)s and individual retirement accounts (IRAs). Underscoring that retirement confidence is strongly tied to retirement plan participation.

In fact, workers reporting they or their spouse have money in an employer-sponsored defined contribution plan or IRA, or have a defined benefit plan from a current or previous employer are more than twice as likely as those without any of these plans to be “very confident” (24 percent with a plan versus 9 percent without a plan). Nearly half (46 percent) of those without a plan were “not at all confident” about their retirement, compared to just 11 percent of those who do have money in a retirement account.

Not surprisingly, 9 of out 10 workers participating in some type of retirement plan had set aside money for retirement, compared with just 2 out of 10 of those who don’t have a plan. When asked about how much they had in savings and investments (excluding the value of a primary residence), nearly half of respondents with a retirement plan (47 percent) said they had at least $50,000 set aside; 1 percent had at least $250,000. By comparison, 73 percent of workers without a retirement plan had less than $1,000.

Workers surveyed seemed to understand the importance of saving for retirement, as 68 percent said they should be saving at least 10 percent of their income annually.

So if workers generally understand the need to save and invest, why aren’t they doing so? The reasons they gave include the cost of everyday living (53 percent), unemployment or underemployment (14 percent), non-mortgage debt (6 percent), mortgage or housing expenses (5 percent), and education expenses (5 percent).

The survey revealed several other interesting points. Below are just a few:

• In 2013, the Department of Labor issued a proposal requiring employer-sponsored retirement plan statements to illustrate how a worker’s current account balance would translate into a lifetime income stream. A large majority (85 percent) of plan participants in this year’s survey said the illustration was at least somewhat helpful, though most said the projected income stream was about what they expected. Of those who said it was less than expected, 35 percent said they would increase their retirement plan contributions.

• The vast majority of plan participants (88 percent) said that it would be at least somewhat valuable if the financial services company that handles their retirement plan offered recommendations about how much they can potentially withdrawal from their plan each year during retirement and make their account values last over a given time period.

• In 2014, less than 1 in 10 workers surveyed said they plan to retire before age 60, while 35 percent of current retirees said they retired before age 60, but not always for positive reasons. Nearly half of retirees left the workforce earlier than planned, with 61 percent of them saying they did so for health reasons or disability, 18 percent did so because of a layoff or closure of their business and 18 percent retired early to care for a family member. On the positive side, 26 percent of retirees surveyed said they were able to afford to retire earlier than planned, while 19 percent said they simply wanted to do something else.

Empowering people with the knowledge necessary to make informed decisions is at the very core of our business. Whether you are in, near or just thinking about retirement, there are steps you can take to maximize the possibility of a financially secure retirement and gain the peace of mind to live confidently.

Join us on Thursday, July 10 at 5:30 pm at the Morgan Hill Community and Cultural Center for our popular educational workshop on Retirement Income Planning. There is no charge to attend.

For more information or to register, go to www.RNPadvisory.com, or call Stacey Sutton at (408) 779-0699.

Survey source: www.ebri.org/surveys/rcs/2014/

DAN NEWQUIST, CFP®, AIF® is a Principal Investment Advisor Representative with RNP Advisory Services, Inc., a registered investment advisor, in Morgan Hill. He can be reached at 408-779-0699 or [email protected]. Securities offered through Foothill Securities, Inc., member FINRA/SIPC, an unaffiliated company.