If you own the property with others as joint tenants, you’re all equal owners.

![]()

By James Ward

James Ward

How do you hold the title to your property? If you bought it or inherited it as an unmarried person, and wish to keep ownership in that form, it might be OK. But what if it’s your intent to own the property with a sibling or friend?

If you co-own a property with someone who isn’t your spouse, you can own it as joint tenants, or tenants in common. With tenants in common, each person can own a different percentage of the property and pass it to whoever they want via will, trust, or by the state’s intestate succession laws. With tenants in common, it will not pass automatically to the other owners at death.

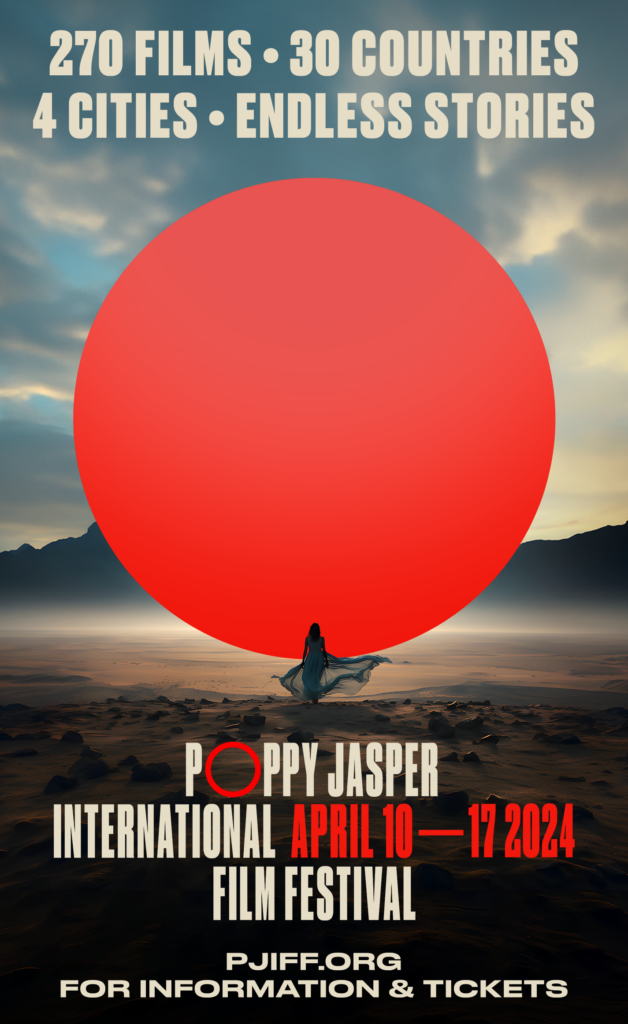

If you own the property with others as joint tenants, you’re all equal owners. If one dies, their ownership passes to the others. I frequently see parents and an adult child owning as three owners as joint tenants, but they tell me the parents own half. This is not correct. Each person owns an equal share. If it is written properly, it can state that the parents own their undivided 50 percent interest as joint tenants, but then their son or daughter does not own as a joint tenant, unless the wording has clarified that there are two parties (couple and child) and not three parties. Otherwise, it is owned by the child as a tenant in common with the parents, with the parents owning their half as joint tenants.

Joint tenancy is preferably written as joint tenants, with right of survivorship. This is the proper way to write it to avoid ambiguity or confusion.

Joint tenancy is preferably written as joint tenants, with right of survivorship. This is the proper way to write it to avoid ambiguity or confusion.

If you own the property with your spouse, you also have the option to hold it as community property, or community property with right of survivorship. If it is owned as community property, and one spouse dies, it will generally pass to the surviving spouse, but it requires an extra step through the courts to get that confirmed. The preferable method of these two is community property with right of survivorship, and that way it clearly passes to the surviving spouse without court involvement.

If you own the property with your spouse, you also have the option to hold it as community property, or community property with right of survivorship. If it is owned as community property, and one spouse dies, it will generally pass to the surviving spouse, but it requires an extra step through the courts to get that confirmed. The preferable method of these two is community property with right of survivorship, and that way it clearly passes to the surviving spouse without court involvement.

If a property is held as joint tenants with right of survivorship, or community property with right of survivorship, transferring the property to the survivor is a relatively simple process of the survivor submitting an affidavit of death of joint tenant, or affidavit of death of community property spouse, along with a certified copy of the death certificate of the deceased person, and the property title is changed.

I’m a trust attorney, so I believe that real estate should be held in a trust, but what if you haven’t gotten around to getting a trust put in place?

I recently had a fairly young guy come see me, and he brought his property deed with him. His young wife had just died, and he wanted to clean up everything and create a trust so he and his children were protected.

The deed simply read: John Smith and Joan Smith, husband and wife.

This is an incomplete form of ownership. They had purchased the home from a developer, and the people preparing the deeds were likely working on dozens of sales at the same time and went with a simple approach and didn’t take the time to explain anything to the buyers. This now creates a big problem for the recently widowed man who is trying to clean up everything following his wife’s death. It isn’t clear that the property is now his.

The court will likely determine that the property is his, but now he’s forced to deal with the cost and time of solving that question before it gets put into his name. Don’t let this happen to you. Review your property deed.